Managing a business in Ottawa—whether you operate in Orléans, Gloucester, Nepean, Barrhaven, Centretown, or Greely—means balancing constant financial responsibilities with the day-to-day demands of operations. Many entrepreneurs start off doing their own books, usually with the intention of “fixing it later,” but at a certain point, the financial signals become impossible to ignore.

These warning signs are not just inconveniences. They indicate risks that can damage long-term stability, result in CRA penalties, or prevent a business from scaling. Recognizing these signs early can save money, protect profitability, and restore control over your financial direction.

Below is a comprehensive look at the real financial red flags Ottawa businesses should never ignore, and how a professional bookkeeper can prevent small issues from turning into major setbacks.

1. You Have No Clear Picture of Your Monthly Financial Health

A common issue among Ottawa entrepreneurs is operating without real financial clarity. If you cannot confidently answer questions like:

- “How much did the business earn this month?”

- “How much cash is available right now?”

- “What expenses are eating into profit?”

…this is one of the strongest indicators you need bookkeeping support.

Businesses in areas like Barrhaven, Orléans, and Nepean especially struggle with this as they grow quickly and financial data becomes too complex for manual tracking. Without updated records, owners end up making decisions based on assumptions instead of verified numbers.

A bookkeeper ensures:

- Accurate monthly financial statements

- Bank reconciliations

- Expense tracking and categorization

- Real-time snapshots of cash flow

This transforms guesswork into informed strategy.

2. Your Cash Flow Is Tight, Unpredictable, or Constantly Off Track

Cash flow issues are extremely common among Ottawa startups and service-based businesses. Contractors in Barrhaven, consultants in Downtown Ottawa, and trades in Gloucester often deal with irregular payments.

Key indicators you may be falling behind include:

- Needing to delay vendor payments

- Juggling invoices to cover payroll

- Taking deposits but having no system to track how they’re applied

- Not knowing when future slow periods might hit

Cash flow is not just about numbers—it’s about timing, forecasting, and organizing receivables and payables.

A professional bookkeeper can create:

- Cash flow forecasts

- Systems for tracking unpaid invoices

- Processes for timely payments

- Alerts for upcoming financial obligations

These help you anticipate problems before they affect daily operations.

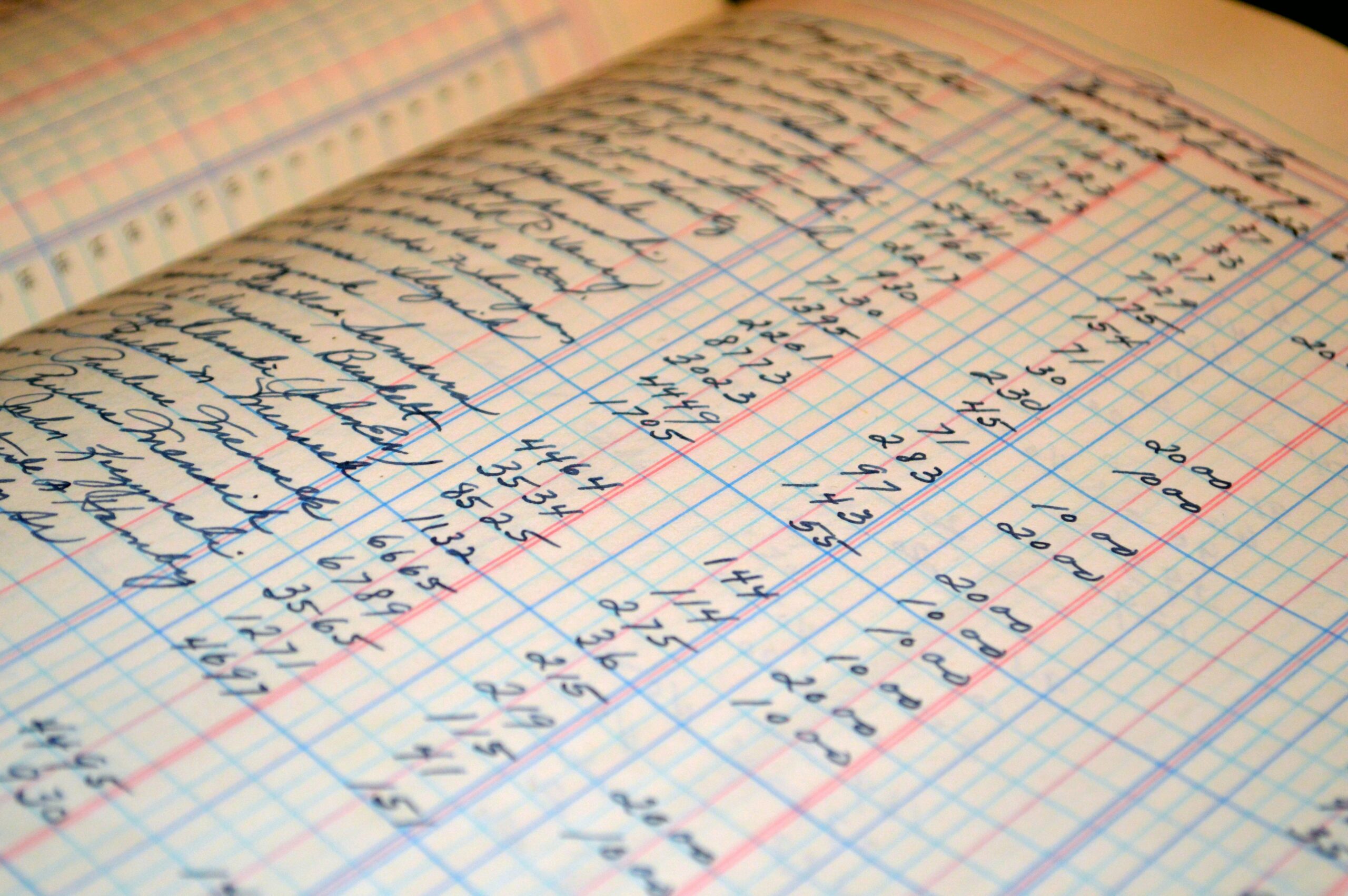

3. You’re Falling Behind on Tracking Receipts, Invoices, or Bank Statements

Entrepreneurs in Ottawa often start with good intentions but eventually drown in paperwork. When income statements and receipts get shoved into folders, glove compartments, or email inboxes, your books become unreliable.

If you find yourself saying:

- “I’ll enter everything this weekend,”

- “I know the receipts are somewhere,”

- “I’ll catch up next month,”

…that backlog can quickly spiral.

Delayed bookkeeping leads to:

- Inaccurate expense totals

- Missed tax deductions

- Compromised year-end reporting

- Increased risk of CRA audit issues

A dedicated bookkeeper ensures everything stays current, categorized, and compliant.

4. Tax Time Is Stressful Every Single Year

Many Ottawa entrepreneurs experience panic during tax season because their books have not been maintained throughout the year.

Common signs include:

- Scrambling to find missing receipts

- Guessing expenses instead of verifying them

- Relying on outdated spreadsheets

- Struggling to calculate HST/GST accurately

- Fear of submitting incorrect information

Businesses in Orléans and Nepean often face extra stress because they operate across both local clients and provincial regulations, increasing reporting complexity.

Accurate bookkeeping ensures year-end taxes are simply a matter of exporting information—not reconstructing an entire year of financial activity.

5. You’ve Received a Notice or Reminder From the CRA

A notice from the Canada Revenue Agency doesn’t always mean something is wrong, but it does mean something requires your attention.

Whether it’s about:

- Late filings

- Missing payments

- Incorrect HST/GST submissions

- Payroll discrepancies

…these are red flags that financial management processes are not where they should be.

Bookkeepers specializing in Ottawa small businesses understand CRA expectations and can help correct issues before they escalate into fines, penalties, or audits.

6. Payroll Is Becoming Complicated or Time-Consuming

As your business grows and you add employees, payroll becomes significantly more complex. Many Ottawa businesses—especially in retail, hospitality, trades, and home-based services—struggle with:

- Calculating overtime

- Managing vacation pay

- Handling employee reimbursements

- Issuing accurate T4 and ROE documents

- Tracking taxable benefits

Payroll errors can lead to unhappy employees and regulatory implications.

A bookkeeper ensures payroll is accurate, compliant, and completed on time, allowing you to avoid administrative headaches.

7. You’re Planning to Expand, Hire, or Take on New Projects

Financial complexity rises dramatically when your business grows. This is especially true for entrepreneurs in fast-growing communities like Barrhaven, Greely, and Riverside South.

Expansion often involves:

- Higher expenses

- More transactions

- Larger inventory demands

- Multiple revenue streams

- Funding or financing applications

To scale confidently, you need accurate financial insight—not rough estimates or outdated spreadsheets.

Bookkeepers help create structured systems that support long-term growth.

8. Your Pricing Feels “Off” but You Can’t Identify Why

If your business struggles to maintain healthy margins, a bookkeeper can provide clarity into:

- Profitability per service or product

- Cost of goods sold

- Operational overhead

- Trends that impact pricing

Many Ottawa entrepreneurs discover, after proper bookkeeping, that they’ve been undercharging for months or even years without realizing it.

Financial visibility enables confident pricing decisions rather than guesswork.

9. You’re Using Multiple Apps With No Unified System

Ottawa businesses increasingly rely on digital tools, but problems arise when systems are not connected:

- Payment apps

- POS systems

- Invoicing platforms

- Spreadsheets

- Receipt capture apps

When nothing syncs properly, your books become scattered and inconsistent.

A bookkeeper integrates these into a unified financial workflow, eliminating duplication, errors, and missing data.

10. Your Business Feels Financially Reactive Instead of Proactive

Business owners often describe their financial processes with phrases like:

- “I’m always catching up.”

- “I don’t know where the money is going.”

- “I only look at numbers during tax season.”

- “I know something is wrong, but I don’t know what.”

These are classic signs of financial reactivity. A bookkeeper helps shift you toward a proactive financial strategy—supported by accurate data, consistent reporting, and clear monthly insights.

Why Ottawa Entrepreneurs Benefit from Local Bookkeeping

Local knowledge matters. A bookkeeper familiar with Ottawa:

- Understands municipal, provincial, and federal reporting expectations

- Recognizes industry trends unique to the region

- Knows the financial challenges of neighborhoods like Orléans, Nepean, Gloucester, and Barrhaven

- Offers tailored support rather than generic solutions

For businesses that want stability, growth, and long-term financial clarity, local expertise makes a measurable difference.

Final Thoughts: Take the Warning Signs Seriously

Every entrepreneur reaches a point where DIY bookkeeping becomes unsustainable. The warning signs—cash flow problems, CRA notices, falling behind on records, payroll issues, and inconsistent reporting—are signals that your business has outgrown basic financial management.

Hiring a professional bookkeeper isn’t an expense; it’s a strategic investment that protects your business and positions it for long-term success.